As we move closer to a cashless society, more people are opting for debit and credit cards, embracing the convenience of digital payments. These options have made life easier by eliminating the need to carry cash, no matter where you are or what time it is. In the past, paying through websites or apps could be challenging and often came with additional costs. Today, however, transferring and receiving money online has become effortless, thanks to apps like Zelle.

Zelle is a leading peer-to-peer payment network created by major banks and financial institutions, including Bank of America, JP Morgan Chase & Co., and Wells Fargo & Co., as a competitive alternative to popular third-party P2P apps. Operating in over 130 countries, Zelle has long held a top position in the market.

If you’re curious about Zelle’s business model, you’re in the right place. In this detailed blog, we’ll dive into Zelle’s business framework, covering everything from its revenue streams and customer relationships to its valuable resources and cost structure. But before we get into the details of its business model, let’s take a closer look at Zelle as a company.

Zelle: Company Overview

Zelle is a payment network that lets users send money quickly and securely from their bank account to someone else’s bank account in no time.

It typically takes a few seconds to complete the transaction. Anyone using the platform can send and receive money for free.

In 2021, Zelle users spent $490 billion on 1.8 billion operations, and nearly 3,000 financial institutions networked with Zelle to make the payment process quick.

The platform is similar to PayPal and lets you send money to friends, family, and other recipients – even if you use different banks across the USA.

Company Name: Zelle – Early Warning Services, LLC

Formerly known as: ClearXchange

Company type: Private

Industry: Payment Service and Payment Network

Founded in: 2016

Headquarters: Scottsdale, Arizona, United States

Services: Electronic Fund Transfer

Website: Zellepay.com

- Using the link to the USA checking or savings account, Zelle allows users to transfer funds to another US bank account holder.

- The payer and the payee must be enrolled in Zelle; they do not need to have accounts at the same financial institution.

- When users transfer money via the Zelle or their bank’s app, the funds are immediately put into the recipient’s bank account, which they have connected to their Zelle account.

- With Zelle, money transactions typically take place in minutes and are free.

- Be aware that Zelle does not support gift cards, international accounts, business debit cards and credit cards.

Build Your App with Confidence

Zelle: The Growth Timeline of a P2P Payment Giant

Zelle has been shining like a star since its launch in 2017 and has continued to grow. For instance, the platform processed $187 billion by facilitating 743 million payments in 2019 alone.

Below are the jaw-dropping statistics and exciting facts to further prove its rocking performance:

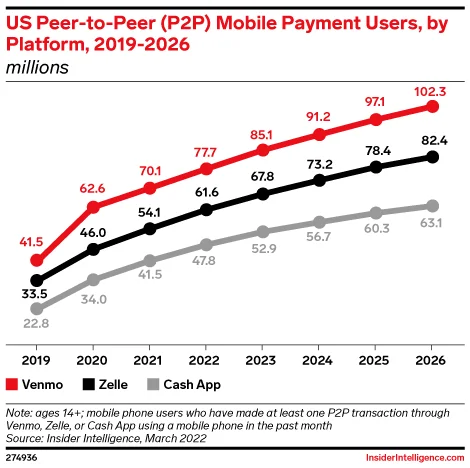

- 1. Zelle grew its user base by 13.9% and 10.01% in 2022 and 2023, respectively.

- 2. In the current year, its user base is projected to grow by 8% in the first six months of 2024.

- 3. The P2P payment platform has managed over 5 billion transactions since its launch in 2017.

- 4. More than 1700 banks and financial institutions offer Zelle in their mobile apps.

- 5. Due to zero transaction fees, small businesses use Zelle to pay employees, vendors, and rent.

- 6. From 2024 to 2026, Zelle user’s average annual growth rate is 6.7%.

- 7. Venmo, CashApp, PayPal, etc., are Zelle’s close competitors, and Venmo’s user base is projected to reach 68.3 million by 2024.

How Does Zelle Work?

If you want to use Zelle but are clueless about how it works, then the first step is to see if your bank operates Zelle. Here’s the step-by-step process that explains how Zelle works and makes it easy for users to send and receive money.

- 1. Unlike Venmo, money transfer through Zelle is like sending money from one bank account to another.

- 2. Usually, conventional banking transfers take 5-7 business days, but Zelle allows users to transfer funds from one account to another in seconds.

- 3. Moreover, it initiates transfers; users don’t need to remember long bank account numbers; they only need an email address or mobile number, and you are done.

- 4. If the money receiver’s bank is a participating partner, they only need to register for the service using the bank’s website or application.

- 5. First-time users may have to wait up to three days to receive payment, but once registered, the recipient can accept the payment.

- 6. Even if the recipient’s bank is not one of the partner’s banks, they can still get the money by installing the Zelle app to their phone, enrolling, and providing a credit card.

Components of Zelle’s Business Model

Zelle, a well-known digital payment network app in the United States, operates on a business model that uses modern technology to facilitate secure and quick payment transfers between individuals, merchants, vendors, and other stakeholders. Here’s a detailed breakdown of its significant elements, components, and partnerships.

- Infrastructure: Zelle is an online payment platform connecting individual financial institutions, allowing users to send and receive money quickly.

- User Interface: It offers an appealing interface to users and allows users to make online payments through its user-friendly website and app solutions.

- Bank Partnerships: Zelle partners with reputed financial institutions across the USA, offering its services to users. These banks include Bank of America, Chase, JP Morgan, PND Bank, Fidelity Bank, Discover Bank, and Wells Fargo.

- Security Measures: To make the overall transactions smooth and secure, Zelle integrates encrypted protocols and authentication methods to stop fraudulent activities.

- Fee Structure: Zelle doesn’t charge any transaction fees, but the platform has various fee policies to carry out smooth transactions.

USP of Zelle Business Model

- Bank Account Integration: Similar to other popular platforms, Zelle directly syncs user’s bank account information, removing the need for third-party integrations.

- Real-time Transactions: Zelle focuses on swift and secure transactions, making sending and receiving money faster while earning attractive rewards and gifts.

- Wide Accessibility: With its broad accessibility, Zelle reaches a broad audience, taking advantage of existing customers and expanding its reach to serve digital customers.

In short, Zelle’s business model revolves around advanced technology and partnerships with banks and financial institutions to offer a seamless online payment experience. It focuses on real-time transactions and direct bank account integrations, which sets them apart in the modern online payment environment.

How Does Zelle Make Money? Have A Look at Its Revenue Streams

Since its launch, Zelle has been making decent revenue, but the platform relies on different revenue streams. No, they don’t charge any commission on each transaction, but all revenue sources focus on partnerships with well-known financial institutions.

Licensing Technology

Zelle levies a fee to its partner banks to provide services to the bank’s clients. In exchange, banks can incorporate Zelle payments into their mobile banking apps, providing clients with an even more convenient way to transfer money between numerous financial institutions with just an email address or smartphone number.

Value Added Services

Zelle’s person-to-person (P2P) payment feature is frequently connected with the company’s bank partners as an added value offering. Essentially, the financial institutions cooperate with Zelle and occasionally advertise the P2P payment system -which forms the basis of the company’s business model – as an extra, paid service.

Bank-Imposed Fees

Although Zelle does not impose transaction fees on its partners, it occasionally does. Similar to the value-added services scenario previously mentioned, more banking and financial institutions are likely to integrate Zelle with their mobile banking apps due to the possibility of charging for additional features like business payments and rapid settlements.

Zelle does not directly benefit from any transaction fees levied by banks; nevertheless, it does increase Zelle’s appeal as a digital payment option by giving the banks a means of making money. This indirectly promotes Zelle’s adoption by additional financial institutions and may contribute to the platform’s quick uptake.

Check Out Zelle’s Competitors and Alternatives

Indeed, Zelle is widespread across the USA digital payment ecosystem, but its inevitable downfall compels merchants and individuals to look for alternatives or other better options.

The major downside of Zelle is that the platform doesn’t let you hold balance within the app. If the company turns out to be fake, you might not be able to get your money back for products or services that you bought online. Refunds are available if the business is found to be fraudulent.

But the good news is many alternative apps let you hold your balance within the app while drawing funds directly from your bank quickly and securely.

Venmo

Venmo is a popular B2B payment app that works like Zelle. Venmo also follows the same business model, making sending and receiving money easy. It is a social payment program app that functions similarly to a digital wallet, allowing you to save money for later usage.

This will be useful if you send money to friends and family regularly. You don’t have to take money out of your savings or checking account when sending money.

Debit or credit cards, as well as bank accounts, can be used to open an account. To use the app, you must have a working phone number. You can pay a fee equal to 1% of the transaction amount to get instant access to the funds if you need to transfer them to your bank account.

PayPal

PayPal is an online payment system headquartered in San Jose, California, that allows users to send and receive money securely via a website or mobile app.

PayPal processes 41 million transactions on average daily, an increase of 20.58% from the expected 34 million transactions processed per day in 2019.

PayPal can also be used to make online purchases when connected to your bank account, debit card, or credit card. It acts as a go-between to safeguard your bank information and can be accessed online, through a mobile app, or in person.

CashApp

CashApp debuted in 2013, providing customers with a convenient option to transfer and receive money without relying on wire services or banks. Since then, the app has expanded its user base and range of services, including an investment platform, direct deposit support, and debit cards linked to CashApp.

Moreover, users can take advantage of cashback offers from popular retailers such as Whole Foods, Walgreens, and Walmart.

CashApp is primarily a smartphone app, available on the App Store and Play Store. It can also be accessed through browsers like Chrome, Mozilla, Firefox, Opera, and more.

Apple Pay

Apple Pay is a mobile wallet and digital payment service launched by Apple Inc. It is compatible with all Apple devices, such as iPhone, Mac, iPad, and Apple Watch.

To make the most of Apple Pay on your Mac, it’s important to update Mac regularly so your system stays compatible with the latest security and payment features.

This payment method utilizes near-field communication (NFC) technology to replace payment cards at contactless point-of-sale (POS) terminals.

Additionally, Apple Pay can be used on specific public transportation networks with credit and debit cards, such as TFL in London and SL in Stockholm, or with certain transit cards, including the Clipper card in the San Francisco Bay Area and the Octopus Card in Hong Kong.

Google Pay

Google Pay, previously known as Android Pay, is a popular payment solution embraced by customers worldwide.

Google Pay serves as a replacement for Android Pay, enabling payments for items purchased in stores, online, and through apps. Leading brands such as Airbnb, Lyft, Instacart, Doordash, and many others have integrated Google Pay into their platforms to ensure seamless transactions.

As part of the Google Wallet app, Google Pay operates in over 50 countries and regions.

How Much Does It Cost to Build an App Like Zelle?

The cashless economy has become more popular. People tend to make payments online, and Zelle is one of the world’s most popular online payment apps.

As you have heard most of the time from reliable and experienced app development companies – telling the exact development cost for Zelle like payment app development, is impossible. Every app is unique, and different factors affect the overall development cost and some of the factors are:

1. Platform choice

2. The number of developers with different expertise and experience

3. Experienced and creative team of designers

4. Features you want to incorporate

5. Location of the app development company (Asia is more cost-effective than other developed countries)

6. Complexity of your app

In short, predicting the cost of developing a Zelle similar app is like buying a new car. The car’s price depends on the features, models, machinery, and more; in the same way, the cost to build an app like Zelle varies depending on multiple factors.

The entire process can take days and even months from start to launch. The process may include:

1. Conceptualization of the idea of the app

2. Building an experienced team of developers and designers

3. Developing UX (prototyping, wireframing, and designing main screens)

4. Development (native and hybrid apps)

5. Test and final launching

This process and cost seem too much. Hence, startups and emerging entrepreneurs usually opt for the white label or ready-made solution as it allows them to hit the market early while saving lots of time and resources. If you are one of those entrepreneurs who want to have an online payment app like Zelle but are clueless about other technicalities, contact us; our team of enthusiastic people will help you develop the roadmap and provide you with a ballpark cost estimation.

Conclusive Thoughts

On one side, apps like Zelle, Venmo, Google Pay, and Apple Pay have been the most significant part of the market’s success and sit at the top. On the other hand, the market is still not saturated and has enough room for more.

We hope this blog helped you gain a complete understanding of the Zelle business model. If you want to plan your idea, White Label Fox is your best bet. By considering all the above aspects, we deliver payment apps with the utmost security as per the demand of the users. So, get an exceptional app like Zelle and take your business to new heights.

Frequently Ask Questions

Zelle is a digital payments platform that enables users to send and

receive money instantly using only their email address or mobile

phone

number. It is integrated with participating banks and credit unions,

making it convenient for users to transfer money between accounts in

real-time.

Zelle works by linking a user's bank account to their phone number

or

email address. When users initiate a payment, the money is

transferred

instantly from one bank account to another, without any fees, as

long as

both the sender and recipient are enrolled in Zelle through their

banks

or credit unions.

Yes, Zelle is free to use for individuals. There are no transaction

fees

for sending or receiving money, as long as the sender and recipient

are

using Zelle through participating banks or credit unions. However,

some

banks may charge fees for certain services related to Zelle.

Zelle primarily makes money by charging banks and financial

institutions

fees for using its platform. Zelle does not charge users directly,

but

it earns revenue through its partner banks, which pay for the

infrastructure, security, and other services that Zelle provides.

Zelle differentiates itself from other payment apps by focusing on

instant transfers between bank accounts. Unlike platforms like

PayPal,

Venmo, or Cash App, which often require users to hold balances in an

app, Zelle transactions are directly linked to bank accounts, making

transfers instantaneous and seamless.

Zelle uses the security infrastructure provided by its partner banks

and

financial institutions to ensure secure transactions. It employs

encryption, multi-factor authentication, and other safety features

to

protect users' financial data and prevent fraud.

Yes, businesses can use Zelle for accepting payments. However, Zelle

is

primarily designed for peer-to-peer (P2P) transactions, so

businesses

must be mindful that the platform lacks some of the features

designed

for larger-scale transactions, such as invoicing, merchant services,

or

fraud protection.

Zelle limits vary depending on the bank or financial institution

that is

facilitating the transaction. Typically, Zelle users can send up to

$1,000 per day for most banks, with some offering higher limits for

verified users or business accounts. It's important to check with

your

bank for specific limits.

Yes, Zelle provides customer support through its partner banks and

credit unions. Since Zelle operates through these financial

institutions, any issues with transactions or account enrollment

should

be directed to the bank's customer support services. Zelle's website

also offers FAQs and troubleshooting guides.

Some drawbacks of using Zelle include:

- Limited to Participating Banks: Zelle can only be used with

banks and credit unions that support it, limiting its reach.

- No Buyer Protection: Unlike other platforms, Zelle does not

offer buyer protection for transactions, making it

unsuitable

for certain types of purchases, especially with unfamiliar

parties.

- No International Transfers: Zelle is currently limited to

domestic transfers within the U.S. and cannot be used for

international payments.

- Limited to Participating Banks: Zelle can only be used with banks and credit unions that support it, limiting its reach.

- No Buyer Protection: Unlike other platforms, Zelle does not offer buyer protection for transactions, making it unsuitable for certain types of purchases, especially with unfamiliar parties.

- No International Transfers: Zelle is currently limited to domestic transfers within the U.S. and cannot be used for international payments.